Fiscal Sustainability Plan

Overview

The City of Sammamish is taking proactive steps to achieve long term fiscal sustainability. The City embarked on a two-phase project in 2022: The initial phase leveraged historical financial data from the prior decade to construct a robust financial forecasting model. In the second phase, the City used this forecast to develop a draft Fiscal Sustainability Plan to provide guidance moving forward.

On November 21, 2023, the City Council received a presentation from the City Manager on the draft Fiscal Sustainability Plan.

Why is this project needed?

The City needs a balanced budget so it can provide services reliably over time. The City must determine how to best serve the community within its revenue.

The City maintains a strategic reserve of operating expenses. Having a buffer allows the City to ensure continuity of service and be prepared for emergencies. The balanced 2023-2024 budget keeps a healthy reserve at the end of 2024. However, projections show that in 2028 the reserve will drop below target.

To balance future budgets, the City may need to reduce its spending, increase its revenue, or a combination. Through this project, the City is proactively addressing the anticipated shortfall. It is fiscally prudent to plan ahead for a future budget gap because solutions may take time to implement.

Fiscal Sustainability Taskforce

Applications for the Fiscal Sustainability Taskforce have closed.

The City Manager created an advisory taskforce for this project that learned about the financial forecast, deliberated budget strategies, and developed a recommended approach.

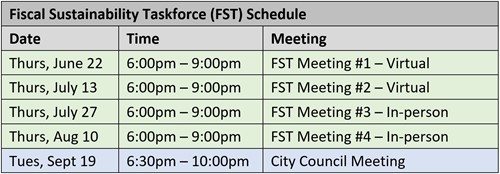

The taskforce met through the summer and presented their recommendations to the City Manager and City Council on September 19, 2023.

Meeting Materials

Taskforce Meeting #1 - June 22, 2023:

Taskforce Meeting #2 - July 13, 2023

Taskforce Meeting #3 - July 27, 2023

Taskforce Meeting #4 - August 10, 2023

Taskforce Meeting #5 - Presentation to City Council - September 19, 2023

Meeting #6 - City Council Discussion - November 21, 2023

Frequently Asked Questions

How far ahead does the City create budgets?

The City operates on a two-year (biennial) budget. The current budget was adopted by City Council in November 2022, setting the City’s 2023-2024 biennial budget.

The City follows the Government Finance Officer Association (GFOA) best practices in budgeting. After adoption of the City's budget, a long-term forecast is developed. This projects future forecasted revenues and expenditures over a six-year planning horizon. The most recent 2023-2028 financial forecast is included as part of the 2023-2024 biennial budget document (starts on page 249).

What kinds of expenses are included in the City budget?

Both operating and capital expenses are included in the City budget.

Some examples of operating expenses are the costs of staffing, supplies, programs, planning, training and maintenance. Notably, the largest operating expenses for the City of Sammamish are its two public safety contracts with Eastside Fire & Rescue (fire and emergency services) and the King County Sheriff’s Office (police services).

Examples of capital expenses are infrastructure investments in roads, sidewalks, parks and trails, stormwater systems, fire stations, and other public facilities and equipment.

Where does the City currently receive revenue from?

The City receives most of its revenue from the local share of property tax and to a lesser extent sales tax. These two general funding sources can be used for any aspect of City governance.

Some other sources of funding, such as criminal justice sales taxes, permit and service fees and real estate excise taxes, are restricted to be used for certain specific purposes.

Outside grant funding supplements these sources of city revenue. Grant funding allows the City to provide additional services and build projects that might otherwise be unaffordable. The City has received and continues to pursue grant funding from a variety of county, State, and Federal sources.

What kinds of reductions might be considered?

The City will look at the cost of programs, services, and capital projects. Reductions, re-phasing, or re-design of capital projects must be carefully evaluated for cost-saving opportunities.

It is also important to evaluate the long-term cost of deferring near-term maintenance. Depending on the asset (such as a road), regular maintenance can extend the life of an asset and provide more long-term savings compared with waiting to maintain it and then facing the full cost of an emergency rebuild upon failure or collapse.

What kinds of new revenue sources might be considered?

The City hired a financial consultant to identify, review and explore potential new revenue sources that could be available to Sammamish. Some possible sources that have been discussed are a transportation benefit district, a tax on utility providers, a general business and occupation tax, and a property tax levy lid lift. Increased cost recovery of city services provided by increasing fees for services and charges could also be reviewed.